Store Clustering

The purpose of this post is to introduce the technique of “Store Clustering” to the reader and to create awareness about the importance of the same. We’ll also touch upon the various reasons for why a retailer would do store clustering.

“Store Clustering” simply means grouping of stores based on certain characteristics, so that stores within a group are more similar to each other with respect to those characteristics, and there is a significant difference between stores of different groups with respect to the same characteristics.

Assume a retailer who has around 100 stores spread across a country like US or China or India. The retailer certainly would want to standardize various aspects across the stores. For instance,

- A retailer may prefer to have a standard merchandize mix across all stores, or

- They may want to compare the store performance of various stores, or

- They would like to implement similar advertising or promotional campaigns across all stores.

If we see the reality, none of these would be possible 100%. The reason is very simple. Not all stores may be similar, in terms of size, format, consumers visiting the stores etc. Thus, when the playfield is not similar, one cannot aim for standardization. But this should not mean that individual store managers must take decisions for their respective stores, in terms of the various factors listed above. Thus there is a need for a trade-off between globally accepting some standards and customizing them to suit the local needs. Store Clustering is the solution for this. I.e. Group those 100 stores into (say) 10 clusters, each containing roughly 10 stores each. Then decisions can be standardized for individual clusters which can then be customized by the store managers.

Now comes the next question – How to cluster the stores? On what basis should one approach the problem? The answer is – The basis on which we do the grouping, or the characteristics based on which we would like to create the clusters MUST depend on the objective that a retailer tries to achieve by Store Clustering. Let us try to understand this with an example.

Let us assume that a retailer wants to create performance metrics for all 100 stores (for example), such as growth in gross sales by product category (in $), decrease in shrinkage (in $) etc. Logically, he or she may think that clustering the stores based on size of the store (area in sq. Ft) may prove good. But what if there are 2 stores (A & B) of same size, but surrounded by totally different consumer population? If one store (A) is surrounded by more number of middle aged men and women, then that store may show a higher increase in sales of liquor compared to the other store (B) . If one store (A) has a competing store nearby, then the average sales itself may be less, compared to the other store (B) of same size. The point is that, area of the store can’t be the suitable factor for doing a clustering in this case.

However, assume that the same retailer wants to compare stores on parameters like attrition rate of employees, or planogram compliance, then the store size (Area in sq ft) “may” be a proper factor. Thus, for achieving different objectives, one may have to group the stores based on different parameters. Hope this gives the basic premise. Now let us see the various factors based on which store clustering can be made. The following are some of the useful factors based on which clustering can be made:

- Store Format

- Demographics – Region, Age group of consumer population, Monthly Income Pattern, Education, Weather, Marital Status

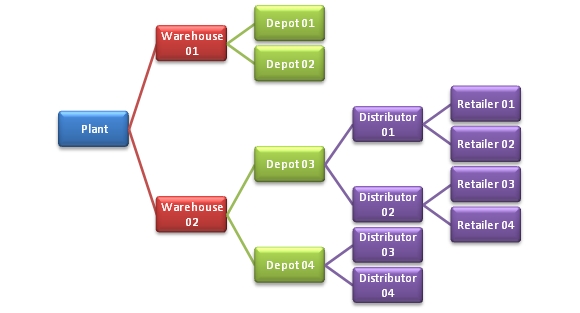

- Adjacency to Schools, Competing stores, Cineplex, Warehouses, Suppliers

How to get these data? Some of these can be obtained from the POS (Point of Sale) itself. Especially when the retailer has loyalty programs, they have access to most of the demographic data. But few other key information can also be obtained from syndicate agencies like Nielsen, TNS & IRI. They provide information on National purchasing pattern for various product categories, Customer trends etc., While trying to use POS Data, we have to be little careful. For instance, a particular product is not being sold at all in a store, but there is a potential to sell the product, which was not discovered till then. But as the POS data doesn’t show any traces of sale, it shouldn’t be assumed that the product is not relevant for that store.

The following tabular column, will give a picture of the various factors used for store clustering and the various underlying objectives. For eg, if there are 2 stores A & B, both are similar in various fronts, but one store (A) has a competing store located nearby, whereas another store (B) doesn’t have any other store in its vicinity. In this case, the retailer may want to devise different pricing strategies for these 2 stores.

Before concluding this post, I would like to touch upon very briefly on the clustering technique as such. “Cluster Analysis” or “Clustering” is a statistical technique in which, based on certain attributes or variables, the entities (in this case – stores) can be grouped. There are various statistical packages, which will take various factors as inputs and do the clustering for us.

For example, one can provide 100 different store records, each with a different rating/score for various factors and let the system determine, the number of clusters. Every cluster will have some unique characteristics. For instance, 1 cluster may have stores with large floor space, have consumers with less average monthly income, poor education and have warehouses situated close to them. Another cluster may have less floor space, consumers with high average monthly income, good education and schools located close to them. Based on the cluster information, the retailer can take decisions about assortment planning, space planning, pricing, promotion planning etc.

I hope that this provides first hand information about store clustering and its benefits. Your suggestions and comments are most welcome.